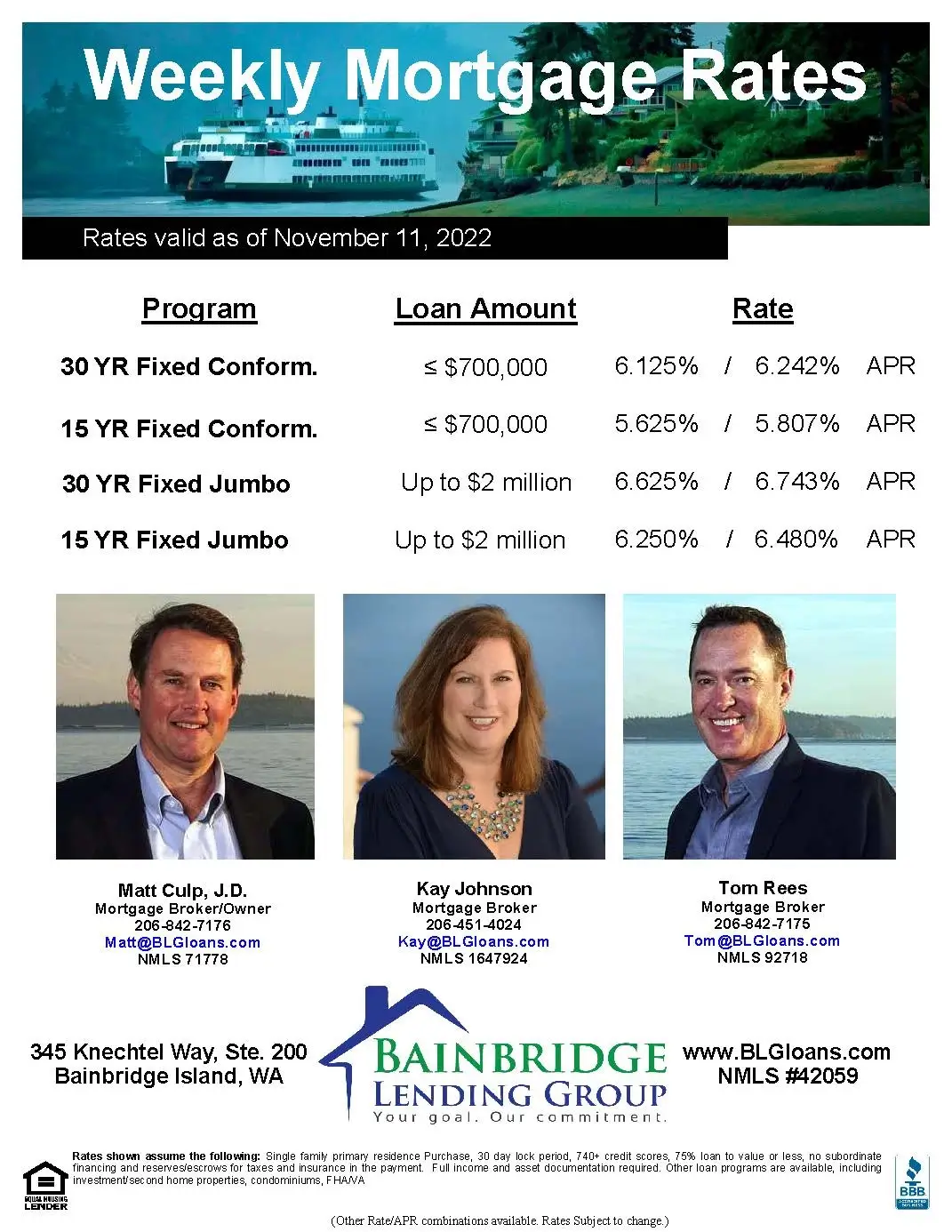

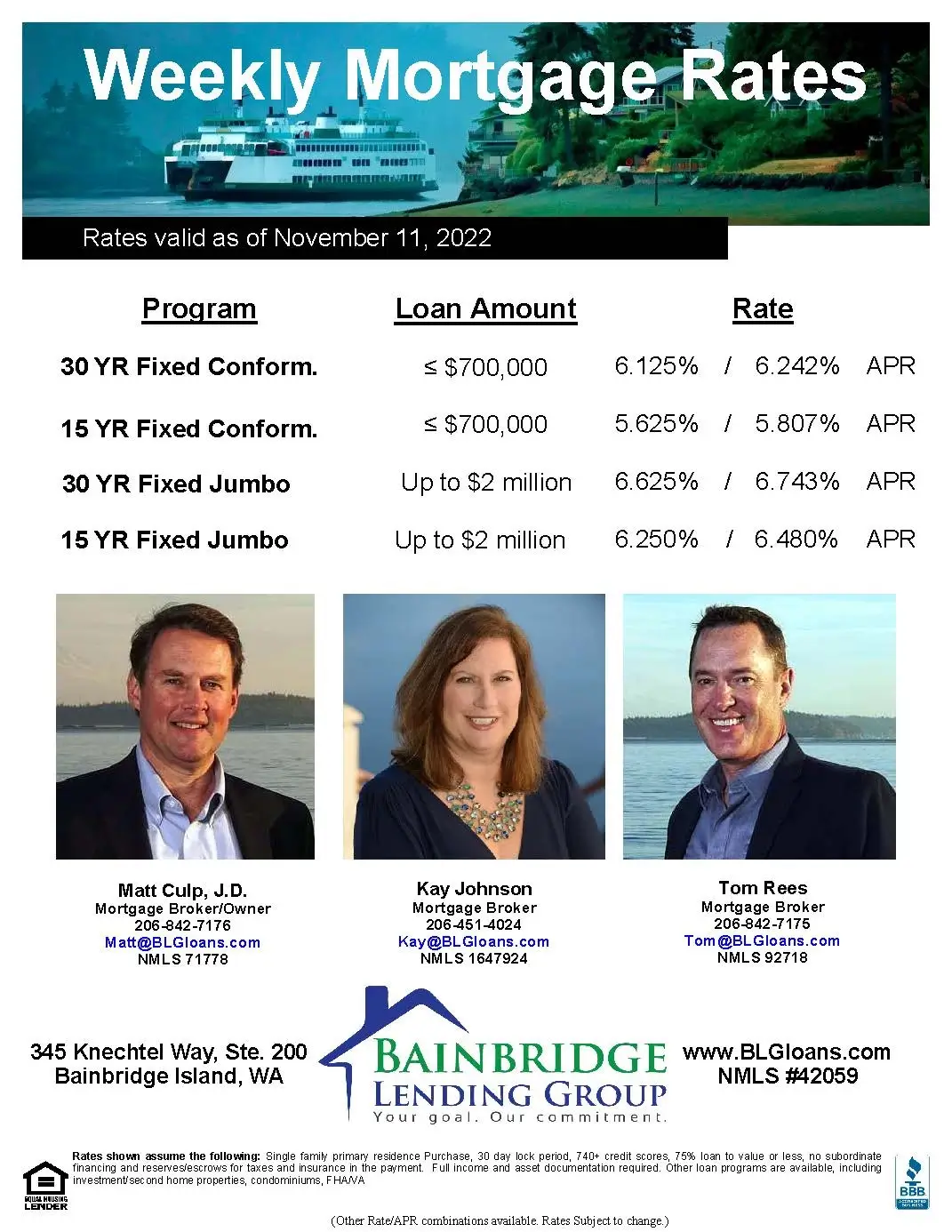

Here are the weekly rates as of November 11, 2022:

-

- 30 Year Fixed Conforming: 6.125% (6.242% APR)

- 15 Year Fixed Conforming: 5.625% (5.807% APR)

- 30 Year Fixed Jumbo: 6.625% (6.743% APR)

- 15 Year Fixed Jumbo: 6.250% (6.480% APR)

For the rate sheet PDF, please click here.

Hi there. Happy Veteran’s Day. Rates ended the week down, way down! The 10 year bond settled at 3.81% down from 4.16% last week. The bond market was closed today for the holiday. The Freddie Mac rate moved up to 7.13% from last week’s 6.95%. Attached is our weekly rates sheet. Please pass it on to anyone you know who could use our assistance.

So why opposite movements between the bond and the Freddie rate? Because, as we have pointed out many times, Freddie’s data is from Thursday to Wednesday and published Thursday morning and this Thursday we had a lower than expected CPI reading for October. So there was a big drop in bond yields and mortgage rates yesterday and a huge stock market pop. We reference the movement in the Freddie rate each week because that data point is often the one used in the media that all of our clients tune into. So it is “old news,” so to speak by the time we get to the weekend. We want you to have accurate and timely data.

And so you may ask “Why that market reaction to still highly elevated inflation?” Does the phrase “data dependent” ring a bell? The lower inflation readings at both the headline and core levels suggests that “rising inflation” may be behind is and that if that is the case, then the Fed, who said they are data dependent when it comes to rate hikes, may start to throttle those hikes back. We may be at or at least closer to the top of inflation readings (CPI) and the Fed rate increase cycle. Given the large move (over reaction?) yesterday, it wouldn’t be surprising to see a bit of a bounce back in yields and rates next week. But we are going in the right direction finally.

Also attached is our Temporary Rate Buydown flyer. Let us know if you have any questions about how it works.

We are around all weekend should you or your clients need us. Thanks and Go Hawks!